blog, blog, blog -nonsense and conundrums

About Me

- Name: kleverasever

- Location: NorCal, United States

funny, genuine, passionate, focused, poor, learner, charmer, pleaser, teaser, first to try and last to cry

Tuesday, August 29, 2006

Monday, August 21, 2006

Thursday, August 17, 2006

Wednesday, August 16, 2006

How to Lie...

How to Detect Lies

Watching facial expressions in order to determine whether a person is lying might just save you from being a victim of fraud, or it could help you figure out when somebody's being genuine. Jury analysts do this when assisting in jury selection. The police do this during an interrogation. A lie detector of course does this, but is a little heavy to carry with you. Therefore, you have to learn the little facial and body expressions that can help you learn to recognize a lie from the truth.

Steps

- Observe how the person smiles.

- Forced smiles are easy to spot since they only involve the muscles around the mouth. The person will appear as being overly relaxed and not really happy. Look at the mouth, and see if you can see the teeth. A real smile will reveal a bit of teeth but a forced smile will not.

- In a real smile, more facial muscles besides the mouth are involved. A dead giveaway is tightening of the eyes, which sometimes causes crows' feet. Very few people can fake a smile and still control their eyes in this manner.

- Watch their hands, arms and legs, which tend to be limited, stiff, and self-directed when the person is lying. The hands may touch or scratch their face, nose or behind an ear, but are not likely to touch their chest or heart with an open hand.

- Check for sweating. People tend to sweat more when they lie.

- See if they are telling you too much, like "My mom is living in France, Isn't it nice there? Don't you like the Eiffel tower? It's so clean there." Too many details may tip you off to their desperation to get you to believe them.

- Notice the person's eye movements. Someone who is lying will be more reluctant than usual to make direct eye contact. Liars also tend to blink more often. A typical right-handed person tends to look towards his right when remembering something that actually happened and towards their left when they're making something up. (This is not verifiable, as there is no reliable study that proves that people who look a certain direction are performing actual recall).

- Be sensitive to the person's emotional expression, specifically the timing and duration, which tends to be off when someone is lying. Emotions can be delayed, remain longer than usual, then stop suddenly. Likewise, they might not match appropriately with verbal statements. And, as with smiling, facial expressions of a liar will be limited to the mouth area.

- Pay close attention to the person's reaction to your questions. A liar will often feel uncomfortable and turn their head or body away, or even unconsciously put an object between the two of you. Also, while an innocent person would go on the offensive, and guilty person will often go immediately on the defensive.

- Be conscious of their wording. Verbal expression can give many clues as to whether a person is lying, such as:

- using/repeating your own exact words when answering a question

- NOT using contractions

- avoiding direct statements or answers

- speaking excessively in an effort to convince

- speaking in a monotonous tone

- leaving out pronouns (he, she, it, etc.)

- muddled sentences

- humor and sarcasm used to avoid the subject

- Allow silence to enter the conversation. Observe how uncomfortable and restless the person becomes when there is a pause.

- Change the subject quickly. While an innocent person would be confused by the sudden shift in the conversation and may try to return to the previous subject, a liar will be relieved and welcome the change. You may see the person become more relaxed and less defensive.

Tips

- Just because someone exhibits one or more of these signs does not mean they are lying. The above behaviors should be compared to a person's base (normal) behavior whenever possible.

- Some of the behaviors of a liar listed above also coincide with those of an extremely shy person, who might not be lying at all.

- Botox or other plastic surgery may also interfere with 'tells' and give false positives.

Warnings

- Be careful how often you use this with your friends. If you are always looking for lies, you may soon not have any friends. Use wisdom.

Related wikiHows

Thursday, August 10, 2006

No wonder I'm so loaded...

NEW YORK (Reuters) -- Left-handed men, often seen as having an advantage over right-handed counterparts in sports like tennis, also enjoy much better paydays, a new study says.

Left-handed men with at least some college education earned 15 percent more than similarly educated right-handers, while those who finished college earned about 26 percent more, wrote Christopher S. Ruebeck of Lafayette College, and Joseph Harrington and Robert Moffitt of Johns Hopkins University in a paper published by the National Bureau of Economic Research.

|

There are "several suggestive and economically and statistically significant results that suggest further support for the notion that handedness matters," they wrote. "We do not have a theory that reconciles all of these findings."

The researchers did not find a similar effect among women.

The data used for the study were hourly earnings taken from the National Longitudinal Survey of Youth, a set of surveys including individuals aged 14-21 in 1979 who were interviewed every year until 1994 and every other year thereafter.

Friday, August 04, 2006

Buy this watch

Need three people to buy one each. $75 each. It is a steal!

Let me know by email and I'll sort it out. Look at the other styles. If you want a different one, I'm game. Swiss Mov't folks... Not a better watch deal to be had!

Thursday, August 03, 2006

Other good ideas...

Click on the list of opportunities below to read more about each of them.

1. Build cheap Wi-Fi networks for Brazilian resorts.

2. Become a biodiesel producer in Argentina.

3. Create an ad network for India's mobile content developers.

4. Launch an exclusive social network for Russian millionaires.

5. Open an American-style restaurant in one of China's fast-growing cities.

6. Remodel homes for China's burgeoning middle class.

7 Flip mining claims in Bolivia.

8. Export the planet's next great wines - from Greece.

9. Import fine wines to upscale restaurants - in India.

10. Export gourmet coffee from Rwanda.

We should start this business!!!

(Business 2.0 Magazine) -- The editors have identified the Best business ideas in the world, which will appear here in a series throughout the next month. Check back daily for updates.

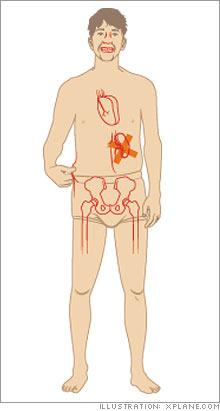

Think globalization means little more than call centers in New Delhi? Then you haven't seen what happens when seriously large numbers of Americans, who spend more than $570 billion at U.S. hospitals annually, start taking health-care holidays in far cheaper climes. Nor have you seen how much money there is to be made by helping them get there.

| |||

| |||

We're about to find out. This year alone, upwards of 500,000 Americans are expected to travel overseas to get their bodies fixed, at prices 30 to 80 percent less than at home.

Medical tourism, as the practice is known, is rapidly becoming the top choice for consumers who grapple with hefty medical bills. Adult Americans who are either uninsured or considered "underinsured" number more than 61 million - a figure that's likely to soar in coming years.

With places like Costa Rica, the Dominican Republic, India, the Philippines, and Thailand pitching their low-cost care, Americans are expected to help turn global medical tourism into a $40 billion-a-year industry by 2010, according to David Hancock, author of The Complete Medical Tourist.

While disruptive to U.S.-based hospitals and HMOs, the overseas stampede is already spawning a brand-new business opportunity: medical tourism agencies. Not only do these companies act as middlemen between patients and foreign physicians, but they also find hospitals, schedule surgeries, buy airline tickets, reserve hotel rooms, and, yes, even plan sightseeing tours for recovering patients. Most important, they aim to reassure customers that cheap does not equal poor quality.

The best balm for anyone setting up a medical tourism agency is this: There are no licensing requirements, either in the United States or overseas. And thanks to free Internet phone services and online advertising, operating costs are relatively low.

"I see the market exploding," says Ted Mohr, an American who runs the Adventist Hospital in Penang, Malaysia, whose non-national customers now make up more than 30 percent of the institution's $32 million annual business (up from less than 5 percent a decade ago). "American health care is getting too expensive for too many people."

Europe, where Polish dentists advertise in in-flight magazines and budget airline Ryanair (Charts) promotes trips to cheap medical havens like Hungary, is ahead of the curve. But U.S. entrepreneurs are beginning to catch up.

MedRetreat, based in Odenton, Md., sent its first patient overseas two years ago. This year MedRetreat expects to ship 320 patients, mostly for cosmetic surgery, to partner hospitals in Brazil, Thailand, and Turkey. The average length of stay: 17 days.

Patrick Marsek, MedRetreat's managing director, says the company makes most of its money through commissions for booking hotel rooms and by pocketing the 20 percent discount on treatment costs that its partner hospitals grant in exchange for referrals.

Revenue is in the six-figure range, Marsek claims, adding that it will hit $1 million before long - especially now that he's looking to branch into more lucrative procedures like spinal fusions and hip resurfacings. "We're getting hundreds of inquiries a week," he says. "We've got our hands full." Marsek doesn't have any medical training.

Neither does Ken Erickson, who was running a fund-raising website in 2004 when a friend who owns call centers in India started talking about that country's first-rate private hospitals. Erickson, 44, hopped a plane to New Delhi, where he toured hospitals and met U.S.-trained doctors. His first thought: "My God, this is the perfect arbitrage situation. Buy below market and sell below market."

In May, Erickson founded GlobalChoice Healthcare, an Albuquerque, N.M., company with $1.5 million in angel funding and 14 employees. The startup has teamed up with medical providers in Costa Rica, India, Panama, and Singapore. It also has a deal with the five-star Taj Hotels Resorts and Palaces chain in India.

In June, GlobalChoice sent a patient to Punjab for a hip replacement that cost about $13,000, including airfare and a 20-day hotel stay. The estimated cost in the United States for the surgery alone? $40,000.

Erickson believes that the big money in medical tourism is in two markets: uninsured retirees ages 50 to 65 for whom Medicare hasn't yet kicked in, and self-insured companies that can no longer afford benefits for workers. He has met with Fortune 100 companies, though "they want to see the market mature first," he admits. If they do sign up, Erickson believes, he's sitting on a $500 million gold mine.

He has reason to be optimistic. Blue Ridge Paper Products, a Canton, N.C., paper manufacturer, may soon allow its 5,500 employees and dependents to go to India for certain company-insured treatments.

In West Virginia, a legislator is pushing a bill that would give incentives to state workers for seeking treatments overseas. "The early adoption has begun," says Arnold Milstein, a Mercer consultant hired by PlanetHospital, a Los Angeles-based medical referral startup, to strike deals to coordinate foreign-based care on behalf of employers and insurers.

To be sure, the medical tourism business is risky. A couple of surgical mishaps are all it would take for a company to lose its customer base. "This is a huge word-of-mouth business," says Sholto Ramsay, founder of Scotland-based Globe Health Tours, a year-old company that has seen a sixfold increase in business in the first six months of this year and will open a U.S. branch this fall.

That means companies like Ramsay's have to spend time and travel money meeting with hospital officials to verify the quality of care and negotiate prices. Hotels need to be outfitted for recuperating patients and have an English-speaking staff. Everything must go flawlessly. This is not a business for the faint of heart.

To thrive, an agency will need a broad presence around the world. Mohr, the Penang hospital CEO, recalls how its patient traffic plunged two years ago when a severe SARS outbreak kept foreigners out of Asia. "That hit us pretty hard," he says, even though business bounced back when the scare ended.

The fear of an epidemic or political unrest shutting down a region is one reason MedRetreat's Marsek is eager to build a strong global network. Another reason: U.S. employers and insurance companies will likely demand it. And what of lawsuits by disgruntled patients? After all, one reason U.S. health care is so expensive is its sky-high malpractice premiums.

Insurance companies don't yet offer medical tourism policies, so agencies like MedRetreat are hoping instead that broad customer waivers, plus an umbrella liability policy, will keep litigation in check. "A lot of companies will come and go," Erickson says. But if you can make it through the relapses, a hale and healthy startup life awaits.

Tuesday, August 01, 2006

Get to it if you're gonna do it!

Offshore tax havens cost U.S. up to $70B

WASHINGTON (Reuters) -- Offshore tax havens used by the wealthy cost U.S. taxpayers $40 billion to $70 billion a year and should be shut down, a Senate panel said in a report naming specific wealthy people as tax haven abusers.

The Senate Permanent Subcommittee on Investigations has probed tax schemes for years, targeting the lawyers and bankers behind them and the companies that used them.

In a new report issued Monday, the panel named individuals, including New York health care heir Robert Wood Johnson IV, Hollywood media mogul Haim Saban and Texas' Wyly brothers, as haven abusers.

"Our investigation blows the lid off tax haven abuses that use sham trusts, shell corporations, and fake economic transactions to hide the fact that U.S. citizens are ... dodging taxes," said Michigan Democratic Sen. Carl Levin.

Minnesota Republican Sen. Norm Coleman, subcommittee chairman, said, "Using offshore jurisdictions to shelter income is unfair ... We need to close these loopholes."

The subcommittee is set to hold a hearing on the matter Tuesday morning. It said Johnson, Saban and Michael French, a former Wyly brothers associate, will testify.

The subcommittee report said that Johnson, Saban and three other, unnamed taxpayers, purchased a tax shelter known as the Personally Optimized Investment Transaction, or POINT, from Quellos Group, a Seattle-based investment firm.

The report said POINT shelters were used to "erase over $2 billion in capital gains that would otherwise have been taxed, costing the U.S. Treasury lost revenue of about $300 million."

The report said law firms such as Bryan Cave and Cravath Swain & Moore worked with Quellos on POINT, while major banks including HSBC provided financing.

Representatives from Quellos, Bryan Cave, Cravath Swain & Moore and HSBC are scheduled to appear at the hearing.

A spokesperson for Saban said he has been cooperating with the subcommittee, and that he relied on a long-term tax advisor in entering into a tax-related transaction in 2001.

The spokesperson said Saban "is in the process of arranging with the IRS and state authorities to pay the taxes, interest and substantial penalties stemming from that transaction."

In a statement, Quellos said it has cooperated with the subcommittee and defended the POINT transactions, saying they were approved by top law firms and registered with the IRS.

"We fundamentally disagree with the report, which presents a one-sided view and ignores all information that is inconsistent with its conclusion," Quellos said.

Johnson is owner of American football's New York Jets and chairman of New York-based Johnson Co., which did not immediately return a telephone call seeking comment.

The subcommittee said the Wylys from 1992 to 2005 moved over 17 million stock options and warrants worth about $190 million into a web of 58 offshore trusts and shell companies.

The Wylys used annuity payment agreements to avoid taxes on the options for years, the panel said.

The options involved came from companies linked to the Wylys - retailer Michaels Stores, Sterling Software and Sterling Commerce, the panel said.

Investment gains from the trusts went to loans, business ventures, real estate and "art, furnishings and jewelry for the personal use of Wyly family members," the report said.

William Brewer, a lawyer for the Wylys, said his clients relied on lawyers and accountants for advice and "continue to believe that their actions were entirely proper under law."

He said the subcommittee report "is reflective of a number of misunderstandings. As such, we hope that it will not mislead people to reach inappropriate conclusions. The Wylys believe they have paid all taxes due."

Coleman and Levin called for reforms such as sanctions on uncooperative tax havens and various tax law changes.